Commercial Drone Insurance

BWI offers comprehensive full-annual, commercial drone insurance policies, designed to protect the policy holder and drone business.

Our commercial drone insurance policies are backed by A+ rated aviation insurance companies and we offer both liability coverage up to $25,000,000 and optional, physical damage coverage for the drones, equipment attached and their payloads.

If you are serious about your drone business, protect it with a comprehensive commercial drone insurance policy from BWI.

What is Commercial Drone Insurance?

A Commercial Drone Insurance Policy is an annual policy designed to protect your drone business from the increased liability risk of operating drones for commercial use. Commercial Drone Insurance policies include liability coverage, which covers your legal liability, in the event that property damage or bodily injury occurs as a result of the operation of your drone. Commercial drone insurance policies also can include physical damage coverage and provide legal defense, in the event that you are sued due to the commercial operation of your drone.

Commercial Drone Insurance Basics

Commercial drone insurance policies are primarily designed to protect the policyholder from the liability damages incurred during the commercial operation of the drone. Most companies will typically require proof of liability insurance for drone operators, prior to allowing them onsite. Companies hiring drone businesses will usually require minimum liability limits of $1,000,000-$5,000,000 depending the companies liability exposure on work site requirements. Some companies may require higher limits up to $25,000,000 in total liability coverage.

Drone businesses that choose a commercial drone insurance policy from BWI, will enjoy several advantages verses pay-as-you-go and hourly drone insurance plans such as:

- Increased liability coverage options $500,000-$25,000,000. Giving you the power to bid the largest commercial drone jobs and the security in having the maximum amount of liability coverage.

- Optional physical damage coverage, including theft, loss of use, coverage for attached equipment and payloads.

- Coverage for advertising liability. Protects the policyholder against claims of stolen ideas, invasion of privacy, libel, slander and copyright infringement related to advertising.

Commercial Drone Insurance Policies Include The Following Industries:

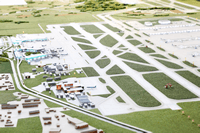

- Agriculture

- Education, Research & Development

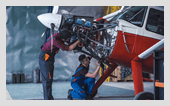

- Infrastructure Inspection & Support

- Mapping/Geophysical

- Movie/TV Production

- Property Survey/Inspection/Real Estate

- Surveillance

- Commercial Photography/Videography

- Events (Concerts/Sports/Weddings etc.)

- Instruction and Training

- Media/News Gathering

- Package Delivery

- Sales/Demo

- Wildlife/Conservation/Environmental

- Construction

- Fire Fighting/Support

- Law Enforcement

- Military

- Private/Hobby

- Search and Rescue

What coverages are typically offered in Commercial Drone insurance policies?

Liability Coverage: Commercial drone insurance policies include liability coverage as standard. Liability coverage protects the policyholder against legal liability for damages arising out of bodily injury or property damage, caused by the operation of your drone. Commercial drone insurance liability also provides you with legal defense, in the event you are sued as a result of the operation of your drone.

Commercial Drone Liability Insurance is typically offered starting at $500,000 per occurrence although our minimum recommended amount is at least $1,000,000. The top-level liability insurance amount that we offer is $25,000,000 and is depend on operator qualifications, jobsite requirements and other underwriting stipulations.

The amount of liability coverage you should get depends on a few factors:

- What are the anticipated jobsite liability insurance requirements?

- How much liability insurance protection do you need to protect your business?

- We recommend carrying at least $1,000,000 in total liability insurance coverage.

- Liability coverages can be increased during the policy if necessary.

Commercial Drone Physical Damage Coverage: Drone Insurance policies also offer physical damage coverage, also known as hull coverage. Hull coverage is an optional coverage and typically covers the full replacement cost of the drone itself, plus any attached equipment like cameras and thermal imaging devices. Hull coverage typically ranges between 8-12% of the amount of coverage you would like. If you are looking for $10,000 in hull coverage, the premium will likely increase by 8-12% of $10,000.

The amount of hull coverage you should get depends on a few factors:

- What is the replacement cost of the drone?

- What is the replacement cost of any equipment attached?

Frequently Asked Questions

Q: What does drone hull insurance cost?Show Answer

A: Drone hull insurance typically costs 8-12% of the hull value. Example: If you wanted $10,000 in hull coverage for your drone or it’s payload, it would cost an extra $800-$1,200 per year. Drone hull insurance is only offered as an add on coverage to a standard Drone Liability Insurance Policy

Q: What insurance companies cover drones?Show Answer

A: BWI brokers with leading aviation insurance companies like Global Aerospace, U.S.A.I.G. and Old Republic to offer annual, commercial drone insurance policies.

Q: What is the best drone insurance?Show Answer

A: The best drone insurance is a full annual commercial drone insurance policy obtained through an aviation insurance specialist broker like BWI.

Q: Does Geico insure drones?Show Answer

A: Geico does not offer drone insurance. We recommend reaching out to BWI Aviation Insurance, for a commercial drone insurance policy.

Q: Should I insure my drone?Show Answer

A: If you are operating your drone for commercial purposes or have a drone business, then yes, you should obtain at least a liability only drone insurance policy.

Q: What does drone insurance cost?Show Answer

A: An annual commercial drone insurance policy costs around $475-$550/YR for 500k in liability only coverage.

Q: How does drone insurance work?Show Answer

A: A drone insurance policy is designed to provide peace of mind and protection, that should make you financially whole again in the event of an accident or incident. There are many variations, exclusions and coverage differences between drone insurance policies, always consult your exact policy for coverage details.