If you’re flying drones in the real world, especially for commercial work, accidents can happen.

Batteries fail. Weather shifts. Equipment malfunctions. And when the pressure’s high, like in disaster zones or time-sensitive mapping jobs, there’s no margin for error.

Recently, we helped a professional drone company navigate all of that.

They had two prior drone crashes, no current insurance, and were gearing up to fly a brand-new VTOL platform with a $16,000 multispectral payload.

On paper, that sounds like a nightmare for most underwriters.

But we got it done.

This is the story of how we helped them go from high-risk to fully insured, and what other drone operators can learn from it.

Meet the Operator: Mapping Disasters, Supporting First Responders

The drone team came to us with a mission that matters:

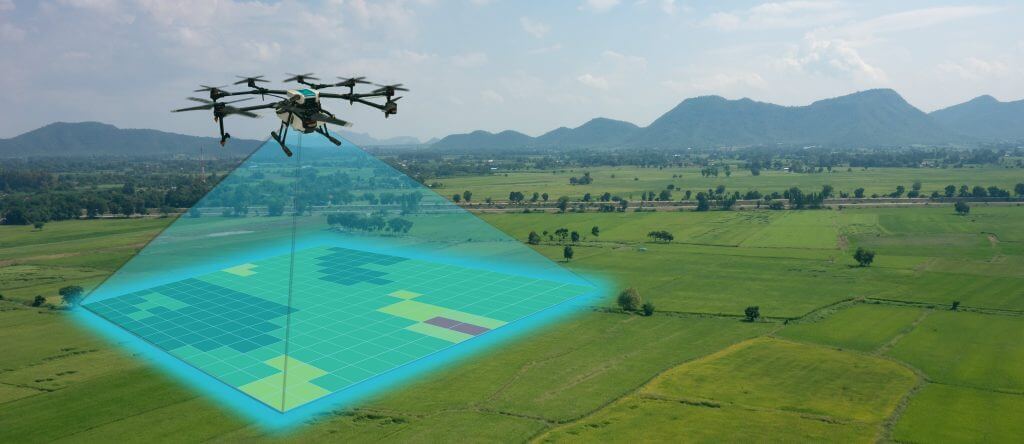

Delivering aerial imagery, mapping, and multispectral data in the aftermath of natural disasters.

They specialize in:

- Damage assessment after hurricanes, floods, and wildfires

- Rapid deployment to support first responders and public safety agencies

- Providing high-res maps and crop imaging for agriculture and infrastructure

It’s not easy work.

These aren’t simple recreational flights. They’re flying under pressure, often in tough environments, with expensive equipment that needs to perform.

Their new fleet included:

- A Quantum Systems Trinity Pro VTOL, a fixed-wing, vertical takeoff drone built for covering long distances quickly

- An Autel EVO II Pro for visual inspections and supplemental aerial coverage

- A MicaSense Altum-PT multispectral sensor ($16,000) for precision ag and post-disaster NDVI mapping

- Plus $5,000 in spare parts and field repair kits

Altogether, over $48,000 in equipment—and no current insurance coverage in place.

The Roadblock: Two Previous Drone Crashes

Most drone insurance carriers ask, “Have you had any UAS accidents or claims in the past five years?”

In this case, the answer was yes.

Two drone incidents, both hardware-related crashes, had occurred during previous operations. The company had paid for the repairs themselves since they were uninsured at the time.

Unfortunately, that put them in a tough spot:

- No previous insurance history

- A flagged loss record

- A brand-new, high-value drone with minimal logged time

That’s the kind of combination that usually gets applications denied, or pushed into unaffordable pricing.

What We Did Differently

At BWI, we’ve insured thousands of drone operators, from solo pilots to nationwide fleets. And we’ve learned something important: Insurance is about the full story, not just the red flags.

Here’s how we approached it:

1. We Built the Right Narrative

Rather than simply submitting raw flight hours and crash history, we highlighted the client’s strengths:

- FAA Part 107 certified pilots

- Over 600 hours of flight time across multirotor and fixed-wing platforms

- Documented safety procedures, including controlled operations and post-crash reviews

- A detailed mission profile focused on education, disaster mapping, and public safety support

That kind of detail gives underwriters confidence. It turns an at-risk application into a real opportunity for partnership.

2. We Structured the Coverage to Match the Mission

We built a quote that covered:

- $1,000,000 in liability coverage

- Full hull coverage for the Trinity Pro, Autel EVO II Pro, and Altum-PT sensor

- Protection for spare parts and payloads

- And critical endorsements like data publishing, fire legal liability, and product liability

By matching the policy to the actual operation, not just a generic template, we created a policy that fit like a glove.

3. We Moved Fast

This wasn’t a theoretical project. The operator had an upcoming deployment within weeks.

We worked quickly to get all documentation submitted, responded to underwriter questions within hours, and had the full policy quoted and issued in time for their mission.

That’s the kind of speed drone teams need when there’s work on the line.

The Final Policy: Affordable and Comprehensive

Despite the past claims and the complexity of the new drone, we were able to get full coverage in place for:

- $1M in liability

- $22,000 hull value for the Trinity Pro

- $5,000 for the EVO II Pro

- $16,000 for the Altum-PT sensor

- $5,000 in spare parts

All for just over $5,300 per year.No gaps. No hidden exclusions. No last-minute surprises.

What Drone Operators Can Learn

This story isn’t just a win for one company, it’s a roadmap for other operators who may be facing similar challenges.

If you’re flying drones for agriculture, inspections, disaster recovery, or R&D, here are a few takeaways:

1. Past crashes don’t automatically disqualify you.

Underwriters want to see that you’ve learned from incidents, not that you’re perfect. Share your flight history, safety practices, and what’s changed since.

2. Get insured before your next big job.

Waiting until the last minute, or flying uninsured, is a recipe for regret. Having a policy in place means you’re protected when things go wrong.

3. Work with a broker who knows drones.

Many general brokers don’t understand the differences between a Phantom 4 and a Trinity Pro, or what BVLOS means for a policy. You need someone who can advocate for you with the right language and structure.

The BWI Difference

We’ve built a specialized team just for unmanned aircraft systems. Whether you’re a one-pilot outfit or a full-scale drone operation, we’re ready to help you:

- Navigate complex application requirements

- Find the right carrier and structure

- Get insured—even if others said no

- And move fast when you have a deadline

Ready to Get Insured?

If you’re launching a new drone operation or flying uninsured right now, we should talk.

You don’t have to have a perfect history. You just need a real mission, a good story, and a broker who knows how to tell it.

Continue Reading