If you fly drones commercially under FAA Part 107, you know that every project, every client, and every location brings its own set of risks. Some jobs require insurance before you can even take off, and many contracts demand proof of coverage for the entire project duration.

For most professional UAV operators, an annual drone insurance policy is the most cost-effective and reliable way to stay protected all year long, without the hassle of purchasing multiple short-term policies.

At BWI Aviation Insurance, we help commercial drone pilots nationwide secure 12-month, contract-ready coveragethat keeps them flying with confidence.

What Is Annual Drone Insurance?

An annual drone insurance policy provides continuous coverage for 12 months from the date of purchase. It’s designed for frequent flyers and commercial operators who want uninterrupted protection for liability, hull, and optional add-ons.

Coverage can include:

- Liability – Protection against injury or property damage you cause to others.

- Hull – Repair or replacement of your drone if it’s damaged, lost, or stolen.

- Payload – Protection for high-value cameras, sensors, or specialized gear.

- Non-owned – Coverage for drones you rent, lease, or subcontract.

- Event coverage – For aerial work at weddings, concerts, sports, and corporate events.

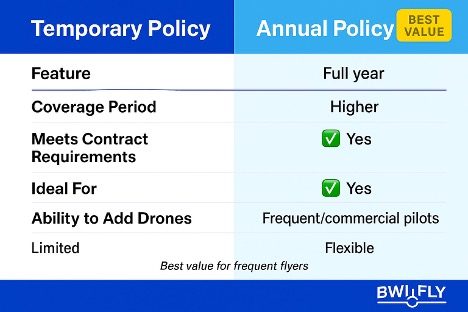

Why Choose Annual Over Short-Term Coverage?

While short-term or “event” policies are useful for one-off gigs, an annual policy offers key advantages:

1. Always Ready for the Next Job

With year-round coverage, you don’t need to scramble to secure insurance for last-minute opportunities.

2. Cost Efficiency

Annual policies usually cost less per day than buying multiple short-term policies.

3. Contract Compliance

Many commercial agreements and government contracts require proof of insurance for months at a time, or for the full year.

4. Flexibility to Add or Change Coverage

Need to add a new drone mid-year? Upgrade your liability limit for a specific job? Annual policies allow you to adjust coverage without buying a brand-new policy.

Annual vs. Short-Term Drone Insurance

What’s Covered in BWI’s Annual Drone Insurance

- Bodily injury – Medical expenses and legal costs if your drone injures someone.

- Property damage – Repair or replacement for third-party property your drone damages.

- Legal defense – Attorney fees, court costs, and settlements.

- Drone hull coverage – Physical damage, theft, or loss of your UAV.

- Payload coverage – LiDAR, thermal cameras, multispectral sensors, cinema rigs.

- Non-owned coverage – Liability for drones you fly but don’t own.

Cost of Annual Drone Insurance

Annual premiums vary based on coverage limits, equipment value, and operation type:

Typical Annual Rates:

- Liability-only ($1M limit): $275–$350/year

- Liability + $2,500 hull: $600–$800/year

- Liability + $10K hull/payload: $1,000–$1,400/year

Factors that affect cost:

- Number and value of drones

- Type of work (real estate, inspection, agriculture, events)

- Coverage limits required by clients

- Pilot experience and safety record

See: Drone Insurance Cost Guide

Who Should Have Annual Drone Insurance?

Annual coverage is ideal for:

- Media & production companies – Real estate, film, corporate projects.

- Construction & inspection firms – Ongoing infrastructure projects.

- Agriculture operators – Crop spraying, mapping, and monitoring.

- Event aerial services – Weddings, concerts, and sports coverage.

- Government contractors – Multi-month or multi-year projects.

Real-World Example: Why Annual Coverage Saves Time and Money

Case 1 – Construction Inspection Company

- Operates year-round across multiple job sites.

- Needs proof of insurance for each new project.

- Annual policy allows them to send COIs instantly, without new policy applications.

Case 2 – Real Estate Aerial Media Company

- Shoots 8–10 properties a month.

- Short-term policies for each shoot would cost 3–4x more over the course of a year.

- Annual policy reduces cost per job dramatically.

Pairing Annual Coverage with Additional Protections

Most annual policies at BWI include liability, and many operators add:

- Hull coverage – Protects your drones from damage and theft.

- Payload coverage – Safeguards high-value equipment.

- Event coverage – Required by most venues for aerial work.

See: Hull Insurance for Drones | Drone Insurance for Events

Why Choose BWI for Annual Drone Insurance

- 45+ years in aviation insurance – We know aircraft, from jets to UAVs.

- Nationwide coverage – Licensed in all 50 states.

- Same-day certificates – Get proof of insurance fast.

- Customizable policies – Tailored to your business needs.

- Top-rated carriers – Only the most reputable insurers.

Read More: About Us

How to Get Annual Drone Insurance from BWI

- Request a Quote – Use our online form or call 800-666-4359.

- Choose Your Coverage – Select liability limits and add-ons.

- Receive Your Certificate – Same-day issuance so you can start flying immediately.

Final Word

If you’re serious about your UAV business, annual drone insurance is the smart choice. It keeps you covered, compliant, and ready for any opportunity, without the repeated expense and paperwork of short-term policies.

With BWI, you’ll have:

- Reliable year-round protection

- Competitive rates

- Customizable coverage

- Fast, responsive service

Request Your Annual Drone Insurance Quote Today >>

Continue Reading