Choosing the Right Coverage to Protect Your Drone Business

If you fly drones for business, choosing the best drone insurance is more than just finding the cheapest premium, it’s about getting the right coverage to protect your equipment, your contracts, and your reputation.

At BWI Aviation Insurance, we’ve been insuring aircraft since 1977, and today we help thousands of FAA Part 107-certified commercial drone pilots nationwide. In this guide, we’ll compare what makes a drone insurance policy “the best,” what coverage you actually need for commercial operations, and why BWI consistently ranks at the top for serious UAV professionals.

What Makes a Drone Insurance Policy the Best?

When researching best commercial drone insurance, you’ll quickly see that not all policies are created equal. The “best” policy for one business might be inadequate for another.

Here are the key qualities to look for:

- Comprehensive Coverage Options

- Liability – Covers injury or property damage to others (a must for commercial pilots).

- Hull – Covers repair or replacement of your drone if it’s damaged or stolen.

- Payload – Protects expensive attached equipment like LiDAR or thermal cameras.

- Non-Owned – Covers drones you rent, lease, or borrow for a job.

- Event Coverage – Satisfies venue and client requirements for aerial filming or photography.

- High Liability Limits

Commercial contracts often require $1M minimum liability, some government bids require $5M or $10M.

- Nationwide Availability

The best providers are licensed to write policies in all 50 states and can insure you wherever your business takes you.

- Fast Certificates of Insurance

Clients won’t wait for your paperwork. The best insurers can issue proof of coverage same-day.

- Industry Expertise

A general insurance agent may not understand UAV risk or FAA rules. The best drone insurance providers specialize in aviation coverage.

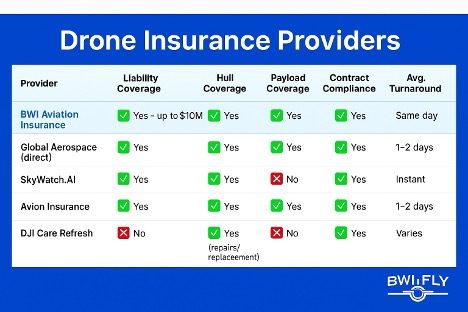

Top Commercial Drone Insurance Providers Compared

Below is a quick look at the most common providers commercial drone pilots consider:

Why BWI Is Consistently Ranked Among the Best

- 45+ Years of Aviation Insurance Experience – We’ve insured every kind of aircraft, including UAVs since the beginning of the industry.

- Nationwide Commercial Coverage – Licensed in all 50 states.

- Custom Policies – From $500K liability for small operators to $10M for large-scale contracts.

- Comprehensive Options – Liability, hull, payload, non-owned, and event coverage all in one place.

- Fast Service – Quotes and certificates issued the same day.

- Top-Rated Carriers – We work with the best aviation underwriters in the market.

Why DJI Care Refresh Isn’t “Best” for Commercial Pilots

Many new Part 107 operators mistakenly think DJI Care Refresh is enough. While useful for equipment replacement, it’s not insurance and doesn’t meet commercial requirements:

- No liability coverage if you cause injury or property damage.

- No coverage for clients’ property or third-party claims.

- No compliance with government or venue insurance requirements.

If you want full protection and the ability to win larger contracts, you need a proper commercial drone insurance policy.

What Does The Best Drone Insurance Cost?

Typical Annual Premiums for Commercial UAV Operators:

- Liability-only, $1M limit: $275–$350/year

- Liability + $2,500 hull: $600–$800/year

- Liability + $10K hull + $5K payload: $1,000–$1,400/year

Factors that affect cost include:

- Type of drone(s) you fly and replacement value

- Your coverage limits

- Your flight operations (real estate, inspection, agriculture, etc.)

- Your flying experience and safety record

See: Drone Insurance Cost Guide

Best Drone Insurance for Specific Industries

- Real Estate Photography & Videography

- Most contracts require $1M liability minimum.

- Hull coverage for your DJI Mavic 3 or Inspire 2.

- Event coverage for on-location shoots.

- Construction & Infrastructure Inspection

- Higher liability limits often needed.

- Coverage for expensive payloads like zoom or thermal cameras.

- Agriculture & Mapping

- Hull coverage for high-value Matrice or Agras drones.

- Payload coverage for spraying systems or NDVI cameras.

- Media & Events

- Proof of insurance required for most venues.

- Event-specific liability coverage for large gatherings.

Learn more: Commercial Drone Insurance/ Part 107 Drone Insurance/ Agriculture Drone Insurance

How to Get the Best Drone Insurance Policy

- Assess Your Risks – List your drone models, payloads, and job types.

- Decide on Coverage – Liability only, or add hull, payload, and non-owned.

- Get Multiple Quotes – But make sure you’re comparing equal limits and coverages.

- Choose a Specialist – Work with an aviation insurance expert who understands FAA and client requirements.

- Get Your Certificate – Before your next commercial flight or contract.

Final Word: Best Isn’t Always Cheapest

When you fly for business, the best drone insurance is the one that protects you from real-world risks, keeps you compliant, and supports your growth. At BWI, that’s exactly what we deliver — with fast service, competitive rates, and unmatched aviation expertise.

Request Your Commercial Drone Insurance Quote Today>>

Continue Reading