If you own or operate a drone, you’ve probably wondered: “What’s the best drone insurance?”

The truth is, there’s no single best provider or one-size-fits-all policy. The “best” drone insurance depends entirely on your drone type, how you use it, and what you need covered.

A weekend hobbyist flying a DJI Mini 4 has very different risks than a commercial operator mapping power lines or spraying crops with an agriculture drone.

In this guide, we’ll walk through how to identify the best drone insurance for you, what to look for in a policy, what to avoid, and why BWI Aviation Insurance consistently ranks among the top choices for drone operators across the country.

What Makes Drone Insurance “The Best”?

The best drone insurance isn’t the cheapest, it’s the policy that actually protects you when something goes wrong. Look for:

- Comprehensive Coverage Options

- Liability

- Hull (physical damage)

- Payload (cameras/sensors)

- Personal injury (privacy claims)

- Non-owned coverage

- Strong Liability Limits

- $1M is the standard for commercial contracts.

- Larger operations often need $5M–$25M.

- Specialized Aviation Expertise

- Many general insurers dabble in drones, but aviation is a complex industry.

- Work with a broker who understands FAA regulations, flight operations, and risk assessment.

- Fast Certificates of Insurance

- If your client requires proof of coverage, delays can cost you contracts.

- Claims Support

- The best insurance isn’t just about buying a policy, it’s about having an advocate if you ever need to file a claim.

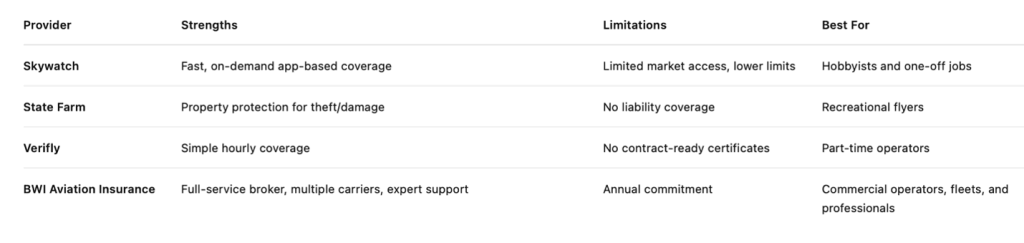

Comparing Major Drone Insurance Options

While convenience-based apps are fine for casual flying, the best drone insurance for professionals and businesses comes from aviation-focused providers who offer comprehensive coverage and dedicated service.

The 5 Core Types of Coverage Every Policy Should Include

- Liability

Protects against third-party damage or injury. Essential for all commercial operators.

- Hull

Covers the cost to repair or replace your drone if it’s damaged or destroyed.

- Payload

Protects expensive cameras, sensors, or LIDAR equipment.

- Personal Injury

Covers privacy or reputational claims arising from aerial footage.

- Non-Owned Coverage

Covers you when renting or borrowing drones.

How to Choose the Best Drone Insurance for You

- Define Your Use Case

- Recreational? Commercial? Industrial?

- The type of flying determines your exposure.

- Know Your Contract Requirements

- Many commercial jobs require specific liability limits and endorsements.

- Get Quotes from Multiple Carriers

- Each insurer evaluates risk differently. A broker like BWI can shop multiple carriers for you.

- Evaluate the Support You’ll Receive

- When you have a claim, do you want an app… or a real aviation specialist helping you?

- Review Exclusions Carefully

- Not all policies cover international operations, night flights, or BVLOS (Beyond Visual Line of Sight).

What Does “Best Coverage” Cost?

Here’s what most pilots can expect in 2025:

- Hobbyists: $300–$600/year for basic liability

- Small Commercial Operators: $500–$2,500/year

- Larger Operations: $2,500–$10,000+ annually

Pricing depends on drone value, liability limits, pilot experience, and use case.

Customer Story: What “Best Coverage” Really Means

A real estate cinematographer insured their drone through a cheap online provider. When their drone crashed into a property, damaging windows and landscaping, their policy covered the drone replacement, but not the $7,500 in property damage.

When they switched to BWI, we structured a comprehensive plan that included both liability and hull coverage. Months later, a similar incident occurred, this time, their liability policy paid out in full, and the client remained happy.

The best insurance doesn’t just replace your drone, it protects your business relationships and reputation.

Why BWI Is Consistently Rated Among the Best

- Specialized Expertise: 45+ years in aviation insurance.

- Multiple Carriers: Access to a full marketplace of aviation insurers.

- High Liability Limits: From $500K up to $25M.

- Fast Certificates: Same-day for contract jobs.

- Dedicated Brokers: Real people who understand your risks.

- Scalable Solutions: From small drone businesses to enterprise fleets.

Conclusion

The best drone insurance is the one that fits your operation, your risks, and your future goals.

If you’re flying for business, working on contracts, or managing a fleet, app-based insurance simply won’t cut it. You need aviation-grade protection from experts who understand your world.

At BWI, we’ve helped thousands of drone pilots secure the coverage they need, at the best possible value.

Get your drone insurance quote today and find out why BWI is one of the best in the business.

bwifly.com / 800-666-4359

Continue Reading