DJI has become the undisputed leader in the drone market. From the compact Mavic series to the powerful Matrice platforms, DJI dominates hobbyist and commercial operations alike. With so many pilots flying DJI drones, it’s no surprise that “DJI drone insurance” is a popular search.

But here’s the catch: DJI doesn’t offer true aviation insurance. What DJI provides is DJI Care Refresh, essentially an extended warranty program that covers certain repair and replacement costs. It’s helpful, but it’s not the same thing as liability insurance or full aviation coverage.

If you own a DJI drone, it’s essential to understand what Care Refresh covers, what it doesn’t, and when you need to step up to real drone insurance from a specialized broker like BWI.

What Is DJI Care Refresh?

DJI Care Refresh is a service plan/warranty program that covers accidental damage to your DJI drone. If your drone crashes, you can send it in and receive a replacement for a reduced fee.

Key features include:

- Accidental damage protection (crash, water, signal loss)

- Up to two replacements per year (depending on plan)

- Rapid replacement turnaround

- Coverage tied to your specific drone serial number

The Pros of DJI Care Refresh

- Affordable Repairs: For a small annual fee, you avoid paying full retail if your drone is destroyed.

- Convenience: Repairs and replacements handled directly through DJI.

- Good for Hobbyists: Ideal for weekend flyers worried about losing their drone to pilot error.

The Limitations of DJI Care Refresh

- No Liability Coverage – Care Refresh does not cover injuries or property damage caused by your drone. If your drone crashes into a car or injures someone, you’re fully responsible.

- Limited to DJI Products – Coverage only applies to DJI drones and only covers replacements, not broader risks.

- Not Contract-Ready – Care Refresh doesn’t provide insurance certificates, which many clients require.

- Replacement Fees Still Apply – You’ll still pay a deductible for each replacement.

When You Need Real Drone Insurance

If you’re:

- Flying commercially (real estate, inspections, agriculture, construction)

- Signing contracts that require $1M+ liability

- Operating in public spaces or around people/property

- Carrying expensive cameras or payloads

…DJI Care Refresh isn’t enough. You need a full aviation insurance policy.

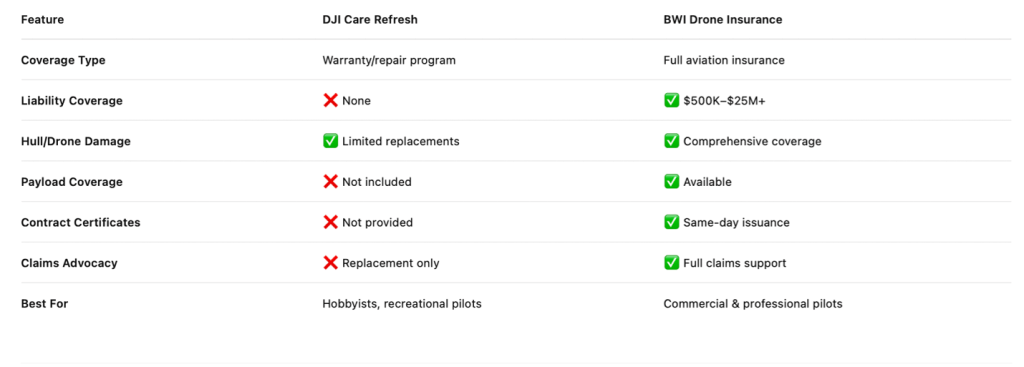

BWI vs. DJI Care Refresh

A wedding photographer purchased DJI Care Refresh when they bought their drone. During an outdoor shoot, the drone malfunctioned and crashed into a guest’s car, causing $4,000 in damage. DJI replaced the drone, but the photographer was still personally responsible for paying the car damages, Care Refresh didn’t cover liability.

Had they carried a BWI drone insurance policy with liability coverage, both the drone and the damages would have been covered.

Why Choose BWI Over DJI Care Refresh

- Liability Coverage – Protects you from lawsuits and property damage claims.

- Contract Compliance – Certificates available within hours.

- Multiple Markets – More options and better pricing than single-carrier providers.

- Scalability – From a single DJI Mavic to an entire commercial fleet.

Conclusion

DJI Care Refresh is a solid choice for hobbyists who only care about replacing their drone after a crash. But for commercial operators, real estate photographers, or anyone flying around people and property, it’s not enough.

If you want to protect your equipment, your clients, and your livelihood, you need specialized drone insurance, not just a warranty plan.

Get your DJI drone insured with BWI today.

bwifly.com /800-66-4359

Continue Reading