When new drone pilots or businesses start flying, one of the first questions they ask is:

“How much does drone insurance cost?”

It’s a fair question, and one that doesn’t have a one-size-fits-all answer. Drone insurance pricing depends on a number of factors including drone value, pilot experience, coverage type, liability limits, and how you use your drone.

In this article, we’ll break down drone insurance prices in 2025, explain what impacts your rates, and share insider tips from BWI Aviation Insurance on how to lower costs without sacrificing protection.

Why Drone Insurance Is Worth Every Dollar

It’s easy to look at insurance as an expense, until you have a claim.

A single drone accident can lead to:

- $10,000+ in equipment replacement costs

- $20,000+ in property damage

- $50,000+ in injury or legal claims

Compared to those risks, a few hundred dollars per year in premium is a smart investment. Drone insurance isn’t about “if” you’ll need it, it’s about protecting your business, your finances, and your reputation.

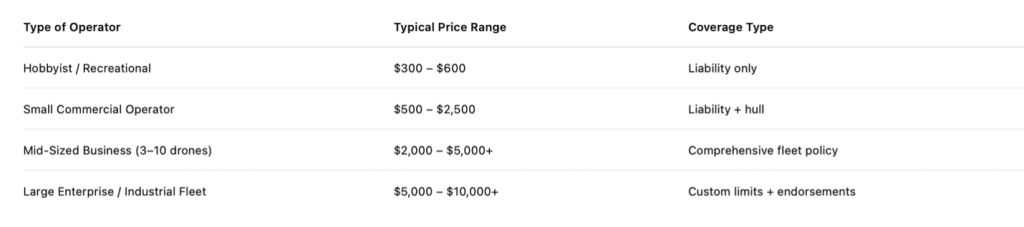

Average Drone Insurance Prices (2025)

Here’s a look at typical annual premium ranges from BWI’s book of business:

Typical Liability Limits:

- $500K → around $300–$600/year

- $1M → around $600–$1,200/year

- $5M+ → $2,000–$10,000+ depending on operations

Factors That Affect Drone Insurance Price

1. Drone Value (Hull Coverage)

Insuring a $1,000 DJI Air 3 is far cheaper than insuring a $40,000 agricultural drone. Hull coverage is calculated as a percentage of your drone’s insured value.

2. Liability Limit

Higher liability limits cost more but protect against bigger losses. Most commercial contracts require at least $1M.

3. Type of Operation

Aerial photography is low risk; utility inspections, agricultural spraying, and large public events carry much higher risk, and higher premiums.

4. Pilot Experience

Pilots with FAA Part 107 certification and logged flight hours often receive better rates.

5. Fleet Size

Multiple drones can often be combined into a single policy, lowering cost per drone.

6. Claims History

Prior losses, accidents, or claims will increase your premium.

Additional Coverage Options That Affect Price

- Payload Coverage: Adds 2–5% of your equipment value to your premium.

- Personal Injury Coverage: Minor cost addition, essential in states like California.

- Worldwide Coverage: Slightly higher premium, but required for international flights.

- Non-Owned Coverage: For renting or borrowing drones; usually a modest add-on.

On-Demand vs. Annual Policies

You may see apps offering drone insurance by the hour or day, sometimes as low as $10/hour. These short-term policies can work for hobbyists, but they’re rarely suitable for businesses or contracts requiring annual proof of insurance.

Annual policies typically offer better value and broader coverage if you fly more than a few times per month.

How to Lower Drone Insurance Costs

1. Get Certified

FAA Part 107 certification not only improves safety, it also signals lower risk to insurers.

2. Bundle Multiple Drones

Fleet policies are more affordable per aircraft than individual coverage.

3. Work with a Specialized Broker

BWI works with multiple aviation carriers to find the best price for your risk profile.

4. Review Your Policy Annually

As your business changes, update your policy. Dropping unneeded coverage or adjusting limits can lower cost.

5. Keep a Clean Record

Avoid reckless operations, log flights properly, and maintain safety documentation. A clean record equals better premiums.

Real-World Example

Aerial surveying company in Texas insured a $20,000 DJI Matrice and $15,000 LIDAR payload. Their annual premium was $2,450 for $1M liability and $35K hull coverage.

After a year of clean operations and FAA training certifications, BWI re-shopped their policy and found them a renewal rate of $1,970, a 20% savings.

Experience, training, and proactive risk management pay off.

Why BWI Offers the Best Value

At BWI, we’re not tied to one insurer. We shop across multiple aviation markets to find the best rates and coverage for your specific needs.

Our clients save time and money because we:

- Compare multiple carrier quotes

- Customize liability and hull limits

- Issue certificates within hours

- Provide claims support from real aviation experts

The Bottom Line

Drone insurance prices vary, but the right policy from the right broker can save you money, protect your operations, and give you peace of mind.

Whether you’re a hobbyist or a commercial pilot managing a fleet, working with an aviation specialist ensures you get the right balance of coverage, cost, and credibility.

Get your personalized drone insurance quote today from BWI, and fly smart, covered, and confident.

bwifly.com / 800-666-4359

Continue Reading