Whether you’re a real estate photographer, agricultural operator, or industrial inspection pilot, drone liability insurance isn’t optional, it’s essential.

But how much does it actually cost?

At BWI Aviation Insurance, we’ve helped thousands of pilots and drone businesses find the right liability coverage. Prices can range from a few hundred dollars per year for hobbyists to several thousand for enterprise operations.

In this guide, we’ll break down drone liability insurance cost by use case, what affects your pricing, and how to make sure you’re covered without overpaying.

Why Liability Insurance Is the Most Important Coverage

Most people think of insuring their drone itself, the hull value. But the biggest risk isn’t replacing your drone, it’s paying for what your drone might damage.

Liability insurance covers:

- Injuries to people caused by your drone

- Property damage (cars, homes, buildings, etc.)

- Legal defense if you’re sued

- Judgments or settlements resulting from accidents

Without liability coverage, one accident could cost tens of thousands, or even hundreds of thousands, in claims.

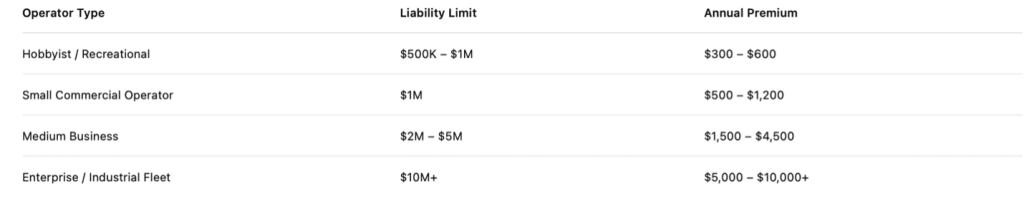

Average Drone Liability Insurance Costs

Here’s what drone operators typically pay annually for liability-only coverage in 2025:

Example Pricing

- $500,000 liability: around $300/year

- $1,000,000 liability: around $600–$1,200/year

- $5,000,000 liability: around $2,000–$5,000/year

Get Your Quote For Drone Liability Insurance Today>>

What Affects Drone Liability Insurance Cost

1. Type of Operation

Filming real estate? That’s low risk. Inspecting wind turbines or flying near crowds? That’s high risk. Your operations directly affect premiums.

2. Liability Limits

The higher your limit, the higher your cost, but also your protection. Many contracts require at least $1M in liability coverage.

3. Flight Frequency

Frequent flyers pay slightly more because exposure to risk increases with more flight hours.

4. Pilot Experience

Experienced, FAA Part 107-certified pilots typically pay less. A clean safety record matters.

5. Claims History

Past crashes, property claims, or lawsuits can raise premiums.

6. Carrier and Broker

Specialized aviation brokers like BWI have access to multiple markets and can shop around for better rates.

Why It’s Worth the Investment

A drone crash that damages a vehicle or building can easily cost $10,000 or more. Add injury claims or lawsuits, and your total liability can exceed $100,000 fast.

That’s why a $600–$1,200 policy is one of the smartest financial moves you can make.

Real-World Example

A wedding videographer was filming an outdoor ceremony when a sudden gust sent their drone into the catering tent, knocking over lighting equipment and injuring a guest.

The total damage and medical costs exceeded $18,000. Their BWI liability policy, $1M in coverage, paid the claim in full, including legal fees. The photographer kept the contract and avoided financial ruin.

Without liability coverage, they would have paid everything out of pocket.

How to Lower Your Drone Liability Insurance Cost

- Get FAA Part 107 Certified – Certification reduces perceived risk and improves pricing.

- Bundle with Hull or Payload Coverage – Combining coverages can sometimes reduce total premium.

- Maintain a Clean Record – Avoid reckless operations and log your flights properly.

- Work with a Specialized Broker – BWI shops multiple carriers to find the best fit.

- Review Annually – As your experience grows, your premiums can go down.

Why Choose BWI for Liability Coverage

- Specialized Aviation Expertise – 45+ years in aircraft and drone insurance.

- Multiple Carrier Access – We compare rates from several aviation insurers.

- Fast Certificates – Meet contract deadlines within hours.

- Dedicated Claims Advocacy – Real people helping you through the process.

- Scalable Coverage – From solo pilots to enterprise fleets.

Comparing the Cost of Being Uninsured

- Minor accident → $2,000 in repairs

- Property damage → $10,000–$20,000

- Injury lawsuit → $25,000–$150,000+

- Legal defense → $30,000+

One claim can easily outweigh a decade of premiums.

Conclusion

Drone liability insurance costs vary by operator and risk, but the value is undeniable.

For most professionals, a $1M liability policy costs less than $100/month, and could save your entire business.

If you’re flying drones commercially, liability coverage isn’t optional, it’s your first line of defense.

At BWI, we make it easy to secure affordable, contract-ready liability coverage backed by aviation experts who understand your business.

Get your drone liability insurance quote from BWI today and fly with confidence.

bwifly.com / 800-666-4359

Continue Reading