If you’re flying drones for business under FAA Part 107, you’re operating in environments where property damage, injuries, and high-value claims are real risks. Even one small mistake could cost thousands, sometimes hundreds of thousands—of dollars.

That’s why drone liability insurance is the must-have coverage for every commercial UAV operator. Without it, one accident could put you out of business or result in devastating personal financial loss.

At BWI Aviation Insurance, we’ve spent over 45 years protecting pilots—including thousands of commercial drone operators, and liability coverage is always the foundation of a solid policy.

What Is Drone Liability Insurance?

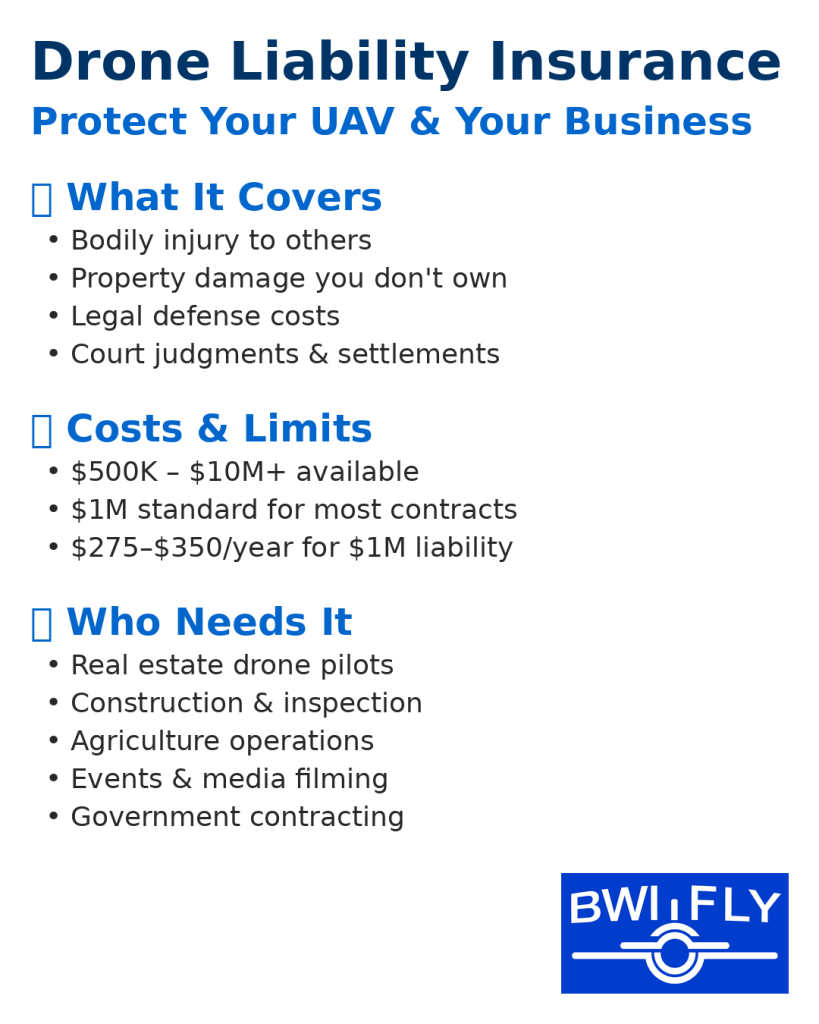

Drone liability insurance protects you if your UAV causes bodily injury or property damage to others. It covers:

- Medical bills and related expenses for injured third parties

- Repair or replacement costs for damaged property

- Legal defense and settlements if you’re sued

Without liability coverage, you’d be personally responsible for these costs—no matter if it was a simple accident or a major incident.

Real-World Scenarios Where Liability Coverage Saves You

Even experienced commercial pilots have incidents. Here are examples we’ve seen:

- Construction Site Inspection Gone Wrong:

Your drone clips scaffolding and damages equipment. Repair bill: $8,000.

- Festival Filming Incident:

UAV malfunctions and injures two attendees. Medical and legal costs: $27,000.

- Real Estate Shoot Mishap:

Drone crashes into a luxury car. Repair bill: $15,000.

What Drone Liability Insurance Covers (and What It Doesn’t)

Covered:

- Bodily injury to people not employed by you

- Damage to property you don’t own

- Legal defense costs

- Court judgments and settlements

Not Covered:

- Damage to your own drone (that’s Hull Insurance for Drones)

- Damage to your own property

- Criminal acts or intentional damage

- Non-U.S. operations without international coverage added

How Much Liability Coverage Should You Have?

Your limit depends on the type of work you do and your clients’ requirements:

- $500,000 – Minimum for very small jobs

- $1M – Standard for most commercial contracts

- $2M–$5M – Government and industrial projects

- $10M+ – High-risk or high-profile work

At BWI, we offer liability limits from $500,000 to $10,000,000+ and can tailor them for each project or client.

Meeting Client and Venue Requirements

Many commercial contracts and venues require:

- Proof of $1M+ liability coverage

- Additional Insured status for the client

- Same-day Certificate of Insurance (COI) before work begins

With BWI, you can request and receive your COI the same day, helping you secure jobs faster.

Drone Liability Insurance vs. DJI Care Refresh

DJI Care Refresh is not liability insurance. It’s a manufacturer repair program for DJI drones, covering repairs or replacements for accidental damage.

DJI Care Covers:

- Repair/replacement of DJI drones for certain damage types

DJI Care Does Not Cover:

- Liability claims

- Property damage to others

- Bodily injury

- Legal costs

- Non-DJI drones

If you’re working commercially, DJI Care is a nice add-on for equipment repairs, but it doesn’t meet contractual insurance requirements.

See also: DJI Drone Insurance vs. BWI

Cost of Drone Liability Insurance

Annual premiums for $1M liability-only policies typically range from $275–$350. Higher limits will cost more:

- $2M liability: ~$400–$550/year

- $5M liability: ~$900–$1,200/year

Your actual rate will depend on:

- Your operation type (real estate, inspection, events, etc.)

- Pilot experience and safety record

- Claims history

See: Drone Insurance Cost Guide

Pairing Liability with Other Coverage

While liability is the foundation, most commercial UAV operators also add:

- Hull coverage – Protects your drone from damage/theft

- Payload coverage – Covers high-value gear like LiDAR or thermal cameras

- Non-owned coverage – For subcontracted or rented UAVs

- Event coverage – For weddings, concerts, and public gatherings

Explore: Hull Insurance For Drones /Drone Insurance For Events

Industries Where Liability Coverage Is Critical

- Real Estate Media – Filming near valuable property and vehicles

- Construction & Inspection – Operating in high-risk job sites

- Agriculture – Working over crops, livestock, and heavy machinery

- Events & Media – Filming in crowded public spaces

- Government Contracting – Bidding on projects with strict insurance requirements

How to Get Drone Liability Insurance from BWI

2. Select Your Limit – Match your typical client requirements.

3. Get Your COI – Same-day certificate so you can start your job immediately.

Final Word

Drone liability insurance is the single most important coverage for any commercial UAV operator. It’s your first line of defense against costly claims, your ticket to securing high-paying jobs, and your protection for the future of your business.

With BWI, you get:

- Fast, same-day service

- Nationwide coverage

- Flexible liability limits

- 45+ years of aviation insurance expertise

Request Your Drone Liability Insurance Quote Today>>

Continue Reading