Whether you’re a student, CFI, or contract pilot flying helicopters you don’t own, non-owned rotorwing insurance is one of the smartest decisions you can make.

But once you decide to get coverage, the next big question is:

“How much liability and damage protection do I actually need?”

There’s no one-size-fits-all answer; what’s right for a CFI logging 1,000 hours per year might not be necessary for a student flying twice a month.

At BWI, we’ve helped thousands of helicopter pilots build policies tailored to their actual flying, and this guide will help you do the same.

What Are the Main Coverages to Consider?

Non-owned helicopter insurance usually includes up to five key components:

- Bodily Injury & Property Damage Liability: Covers injury to passengers or people on the ground, plus damage to property

- Damage to Non-Owned Aircraft: Covers the helicopter you’re flying if you’re legally liable for damage

- Deductible Reimbursement: Pays the deductible on the owner’s hull policy

- Legal Defense: Covers your legal costs if you’re sued (included in most policies)

- Medical Payments: Covers basic medical expenses for passengers

Liability Coverage

This is the most essential part of your policy. It covers injuries and property damage you may cause while operating a non-owned helicopter.

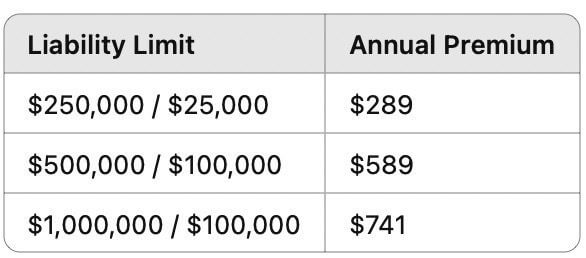

Here are some sample limits and real annual premiums:

So what’s the difference? The first number is your total liability limit per occurrence. The second number is the cap per passenger.

Example: If you have $1,000,000 / $100,000 and you crash with 3 passengers injured, the most you can pay per passenger is $100K, even if the total liability is higher.

How to Choose the Right Liability Limit

Ask yourself:

- Do you fly with passengers regularly?

- Are you flying in urban or high-density areas?

- Would your personal assets be at risk in a lawsuit?

If the answer is yes to any of these, we recommend $1,000,000 / $100,000 minimum.

If you’re flying solo, in rural areas, or under direct instructor supervision as a student, $500,000 / $100,000 may be sufficient.

Damage to Non-Owned Aircraft

This coverage pays for physical damage to the helicopter you’re flying if you’re at fault.

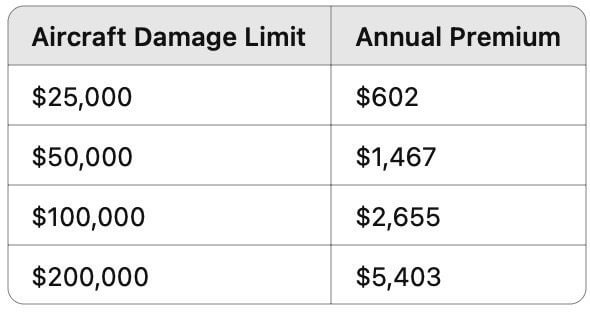

Common limits and pricing:

So how much do you need?

Simple: Match it to the value of the aircraft you typically fly.

Most R22s are worth $125K–$300K

R44s: $200K–$400K

R66s: $900K–$1.4M+

But even $25K–$50K in coverage can protect you from having to pay the owner’s deductible or a portion of the claim.

When Damage Coverage Is Essential

- You’re flying with students

- You occasionally solo or PIC the aircraft

- You fly high-value helicopters (R44, R66, EC120, etc.)

- The aircraft owner has a high deductible

Deductible Reimbursement

Let’s say your student rolls an R44 and the school’s insurance pays for the damage. Their deductible is $5,000. Guess who’s on the hook for that? You, the instructor.

Adding deductible reimbursement ensures your non-owned policy covers the deductible, up to the limit selected.

Typical cost:

- $5,000 reimbursement = $124/year

Medical Payments

This covers basic first aid and emergency costs for passengers, regardless of fault.

Typical limits and pricing:

- $5,000 = ~$186/year

- $10,000 = ~$376/year

It’s not required, but it adds a layer of goodwill and peace of mind, especially for instructors flying with clients.

Which Combination Is Right for You?

Here are a few common pilot profiles and the policies we recommend:

Student Pilot (Training in R22)

- Liability: $500K / $100K

- Aircraft Damage: $25K

- Deductible Reimbursement: $5,000

- Medical: Optional

Total Premium: ~$1,100–$1,400/year

CFI (Full-time, 3–4 flights/day)

- Liability: $1M / $100K

- Aircraft Damage: $50K–$100K

- Deductible Reimbursement: $5,000

- Medical: $10K

Total Premium: ~$2,000–$2,600/year

Contract Pilot (Part 135 Backup, R66)

- Liability: $1M / $100K

- Aircraft Damage: $100K–$200K

- Deductible Reimbursement: $5,000

- Medical: $10K

Total Premium: ~$3,000–$5,500/year

Mistakes to Avoid

- Choosing low liability just to save money

- Not matching aircraft damage limit to real aircraft value

- Forgetting deductible reimbursement

- Flying without knowing whether you’re covered

- Assuming the school or owner’s policy protects you, it probably doesn’t

Final Thoughts

Non-owned rotorwing insurance isn’t a luxury; it’s a must-have for any pilot flying helicopters they don’t own.

Whether you’re an instructor, a student, or a professional contract pilot, the right limits matter.

At BWI, we’ll help you:

- Choose the right limits

- Quote quickly

- Stay fully protected

Call (800) 666-4359 or click below to request your non-owned helicopter quote today.

GET NON-OWNED HELICOPTER COVERAGE

Continue Reading