The drone industry is booming. From agriculture and construction to filmmaking and delivery logistics, drones have become indispensable tools for modern businesses. Alongside this growth, insurance has become a critical requirement. Operators need liability coverage, hull coverage, and sometimes specialized add-ons to meet FAA regulations, client contracts, and real-world risks.

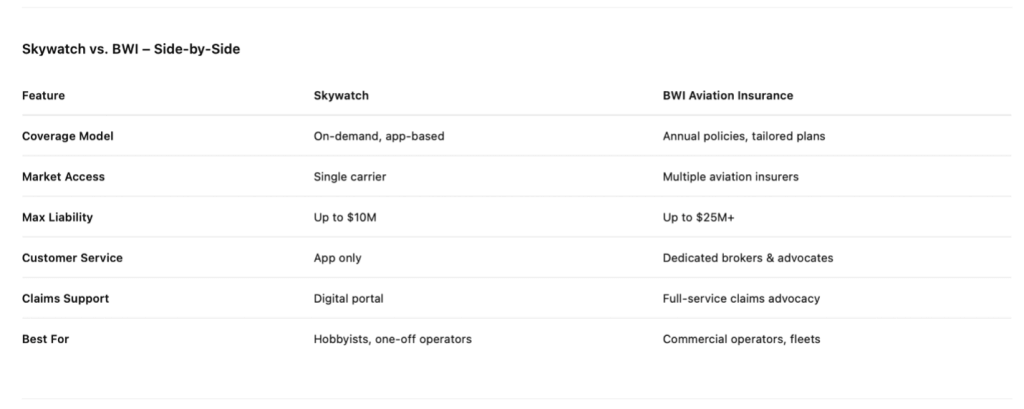

When drone operators search for insurance, one name that often comes up is Skywatch.ai. Known for its app-based platform and flexible on-demand coverage, Skywatch has carved out a niche for hobbyists and smaller operators. But does it stack up against a full-service aviation insurance brokerage like BWI Aviation Insurance? Let’s explore.

What Skywatch Drone Insurance Offers

Skywatch is positioned as a digital-first insurance solution. Through their app, operators can:

- Buy insurance by the hour, day, month, or year

- Select liability limits up to $10M

- Add additional insureds for contracts

- Get instant proof of insurance

This flexibility appeals to hobby pilots and small drone businesses who want speed and convenience without speaking to an agent.

The Pros of Skywatch

- On-Demand Coverage: Perfect for one-off shoots or weekend flights.

- Affordable for Small Projects: Lower upfront costs for those who don’t fly often.

- Simple Mobile App: Fast quotes, fast coverage.

The Gaps with Skywatch

However, Skywatch’s convenience model isn’t always a perfect fit. Common challenges include:

- Limited Market Access – Skywatch offers policies through a single carrier. If that carrier declines your risk, you’re out of options.

- App-Only Servicing – No dedicated broker to help with contract reviews, claims, or unique coverage questions.

- Coverage Limitations – Hourly coverage may not satisfy corporate or government contract requirements that demand annual policies and high liability limits.

- No Aviation Specialization – While Skywatch is focused on drones, they lack the deep ties to the broader aviation insurance market that a broker like BWI can leverage.

What BWI Offers Drone Operators

BWI Aviation Insurance is a specialized aviation brokerage with over 45 years in the industry. We insure everything from single drones to entire fleets, and our policies are backed by top-rated aviation insurers. Here’s what sets BWI apart:

- Dedicated Aviation Brokers: Real people, ready to help you compare options and tailor coverage.

- Multiple Insurance Markets: We shop across multiple carriers to secure the best coverage and pricing.

- Contract-Ready Policies: Liability limits up to $25M, worldwide coverage, and specialized add-ons.

- Claims Advocacy: If you have a claim, BWI stands by your side — not just an app notification.

- Scalable Coverage: Whether you’re an individual pilot or a growing drone company, your insurance grows with you.

Real-World Example

One of our recent clients, a drone photography business, started with Skywatch because it seemed quick and cheap. But when they signed a major contract with a construction company, they hit a wall: the contract required a $10M liability policy plus worldwide coverage. Their Skywatch app couldn’t issue the policy, and they needed proof within 48 hours.

They called us at BWI. Within one business day, we had them covered with a contract-compliant policy that satisfied their client, secured their project, and gave them peace of mind.

Conclusion

Skywatch is a solid choice for casual drone operators and hobbyists who want temporary, app-based coverage. But if you’re serious about flying drones commercially, signing contracts, or scaling your drone business, a specialized aviation broker like BWI is the clear choice.

At BWI, we combine personal service, access to multiple carriers, and decades of aviation expertise. Your drone business deserves more than an app, it deserves a partner.

Get your drone insurance quote today from BWI.

bwifly.com / 800-666-4359

Continue Reading