When drone pilots start looking for insurance, one of the first names that comes to mind is State Farm, one of America’s largest insurers, known for auto, homeowners, and business policies.

Many drone owners wonder: “Can I just insure my drone through State Farm?”

The short answer: Yes, but only in a limited way.

State Farm may offer personal articles or business property coverage for drones, but that’s not the same as full aviation insurance. If you’re flying commercially, signing contracts, or operating high-value drones, you need a dedicated policy built for aviation, and that’s where BWI Aviation Insurance comes in.

What Type of Drone Coverage Does State Farm Offer?

State Farm’s most common drone coverage is through a Personal Articles Policy (PAP) or Business Personal Property (BPP) endorsement.

Personal Articles Policy (PAP):

- Typically covers theft, accidental damage, or loss.

- Often limited to recreational or personal-use drones.

- May require serial numbers and proof of ownership.

Business Personal Property (BPP):

- Can extend coverage to drones used in business operations.

- Usually requires the drone to be scheduled (listed individually).

- May offer protection for damage or theft.

These coverages can help replace your drone if it’s damaged or stolen, but that’s where the protection stops.

The Problem: No Liability Coverage

Here’s the critical gap:

State Farm does not provide aviation liability insurance for drones.

That means if your drone causes injury, property damage, or a privacy lawsuit, you’re completely unprotected.

Example:

If your drone crashes into a car, injures a bystander, or breaks a client’s window, your State Farm policy likely won’t cover it.

Most pilots only find this out after an accident or when a client requests proof of liability coverage and State Farm can’t provide it.

Why Liability Coverage Matters

Liability insurance is the foundation of every commercial drone policy. It:

- Covers third-party injury and property damage

- Includes legal defense costs

- Meets contractual insurance requirements

Without it, you could be personally responsible for damages or lose high-paying jobs that require proof of coverage.

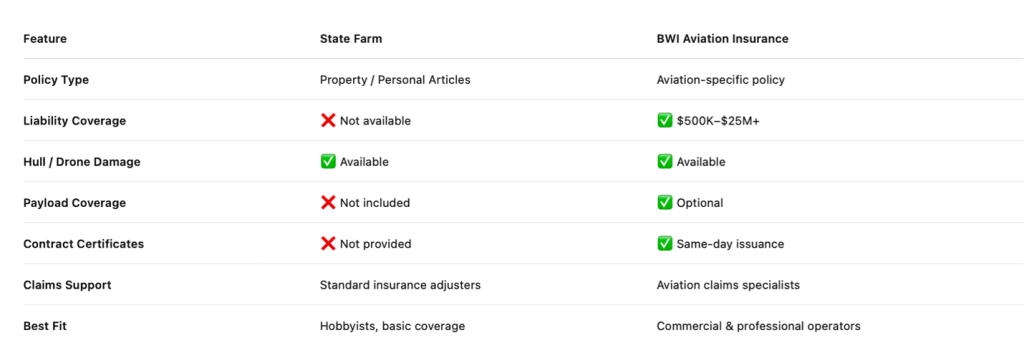

BWI vs. State Farm: Key Differences

Real-World Example

A professional drone photographer had his drone covered through State Farm’s personal articles policy. One day, during a property shoot, the drone lost connection and crashed into a parked vehicle, causing $6,000 in damage.

State Farm replaced his drone, but denied the liability claim for the damaged vehicle. The photographer had to pay out of pocket and lost the client.

Afterward, he came to BWI and purchased a $1M liability policy. When he later signed a contract requiring $2M coverage, we updated his policy same-day so he could keep flying without missing opportunities.

Why Choose BWI for Drone Insurance

- True Aviation Policies: Liability, hull, payload, personal injury, and more.

- Higher Limits: From $500K to $25M+ to satisfy contract requirements.

- Fast Certificates: Meet deadlines and client needs in hours, not days.

- Multiple Markets: Access to several aviation insurers for better rates and flexibility.

- Dedicated Brokers: Real people who specialize in aviation — not general adjusters.

When State Farm Might Be Enough

To be fair, State Farm can work for:

- Hobbyists flying for fun (no commercial activity)

- Drone owners only concerned about theft or loss

- Pilots who just want minimal property coverage

If that’s you, a personal articles policy might fit your needs. But if you’re flying for business, signing contracts, or need liability protection, it’s not enough.

Conclusion

State Farm is a trusted name in general insurance, but their drone coverage is property-only, not aviation-grade. It won’t protect you from the biggest risks, lawsuits, injuries, and client contract requirements.

That’s where BWI steps in. As a specialized aviation broker, we provide comprehensive coverage built specifically for drone operations.

Whether you’re a hobbyist upgrading to commercial work or a drone business managing a fleet, BWI helps you fly confidently, fully covered, fully compliant.

Get your drone insurance quote today at BWI.

bwifly.com / 800-666-4359

Continue Reading